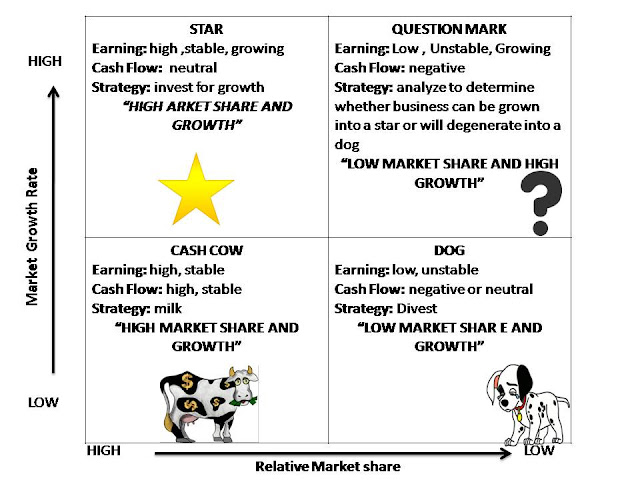

The “Star” quadrant describes companies with high market share in a high-growth industry.īy exhibiting strong historical growth (and a pipeline of promising future opportunities) alongside high market share, stars are perceived as the most favorable products for those seeking the highest risk-adjusted returns. The required reinvestment activity and overall efforts are minimal to sustain the historical levels of cash generation for such companies. such companies are boring but profitable.

The one drawback is that because the markets are mature, the overall growth rate is low with limited opportunities to reinvest or expand into different markets, i.e. The term “Cash Cow” encompasses companies with a high market share in a slow-growing industry.įor such companies, neither profitability nor liquidity is an issue. Learn More → Hedge Fund Primer Quadrant 1.

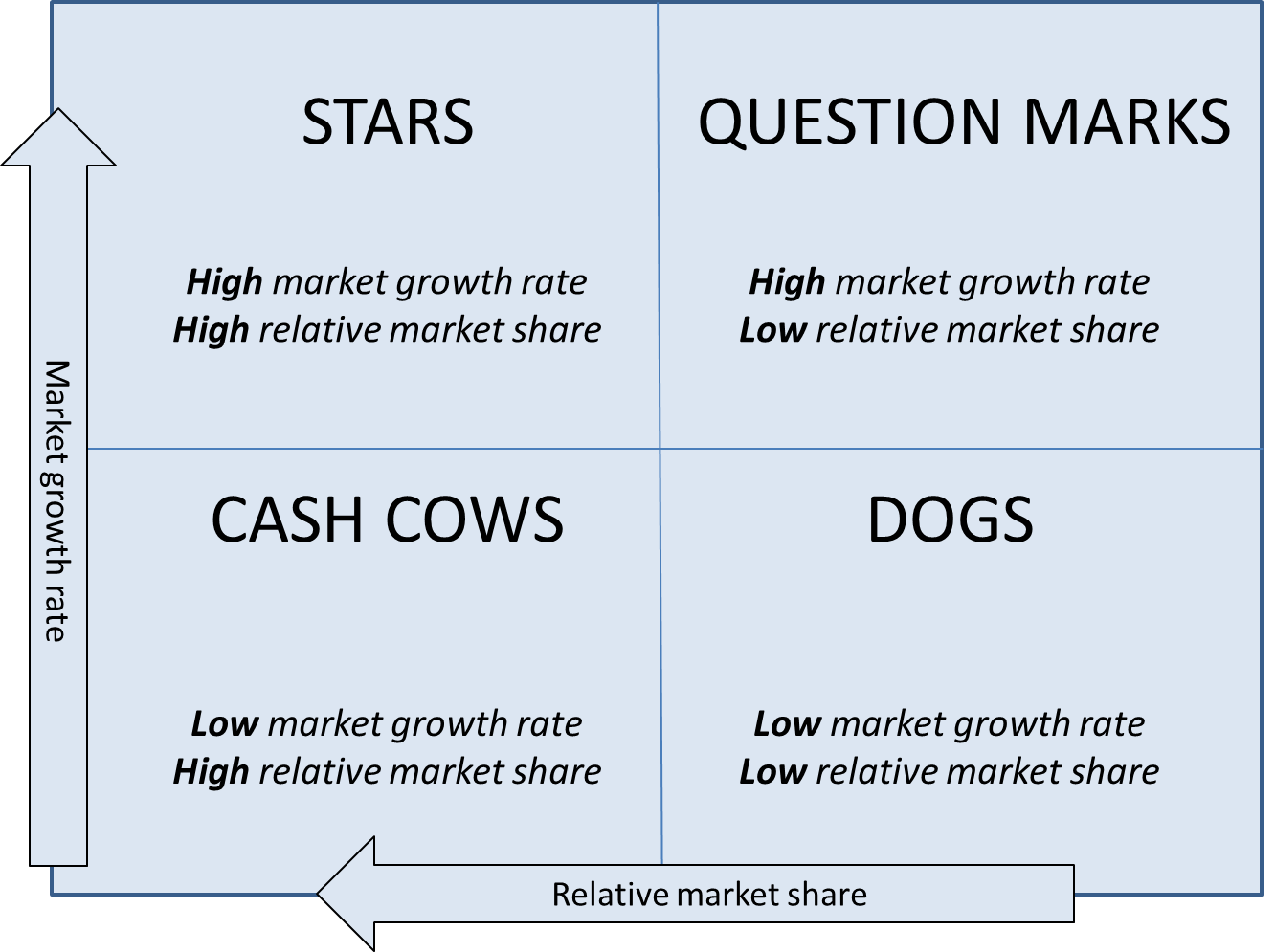

The image below shows the common version of the BCG matrix. Question Marks → High Growth Low Market Share.Cash Cows → Low Growth High Market Share.The four quadrants of the BCG matrix are as follows. The structure of the BCG matrix plots a company’s products or strategic business units (SBUs) on a four-square matrix. BCG Growth Share Matrix: Four Quadrants Structure The BCG matrix assesses the growth opportunities available for a specific product portfolio by conducting a two-dimensional analysis based on two parameters:īy examining a product’s potential and the prevailing (and predicted) market environment, companies can make an informed decision on where to invest more capital, develop new products/services, or divest certain assets. The BCG matrix enables a company’s management team to derive insights and develop a plan to improve their current product offerings, focusing on new information about new opportunities to pursue in their current (or adjacent) markets. The BCG growth-share matrix is a framework for companies to reference when refining and prioritizing their different businesses (and strategies).

The growth share matrix created by the Boston Consulting Group (BCG) is a tool for identifying new growth opportunities and making informed capital allocation decisions to achieve long-term, sustainable growth. The BCG Growth Share Matrix is a framework designed for companies to better understand a market’s current and future competitive landscape, which helps determine their long-term strategic plans.īCG Growth Share Matrix: Strategic Management Model

0 kommentar(er)

0 kommentar(er)